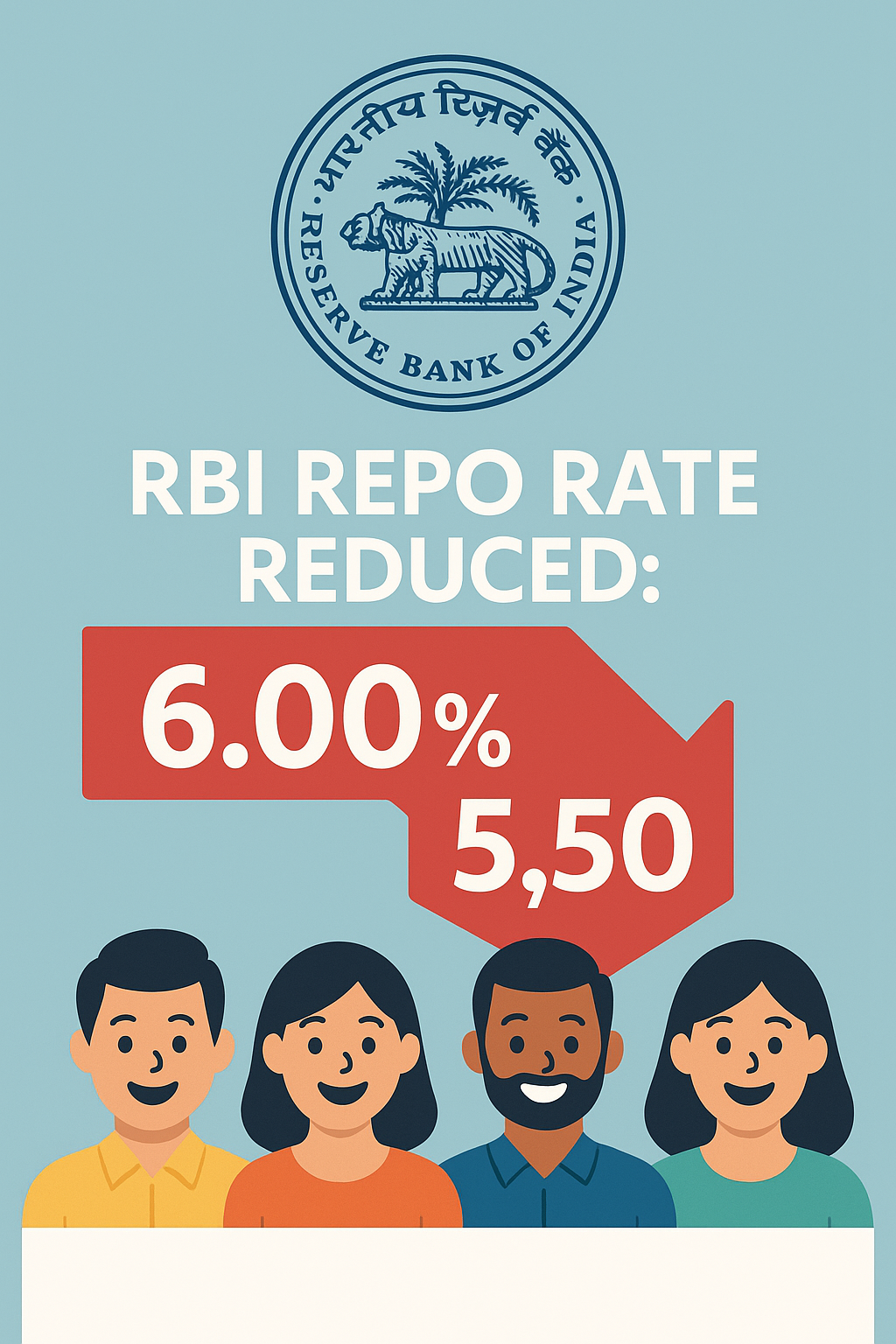

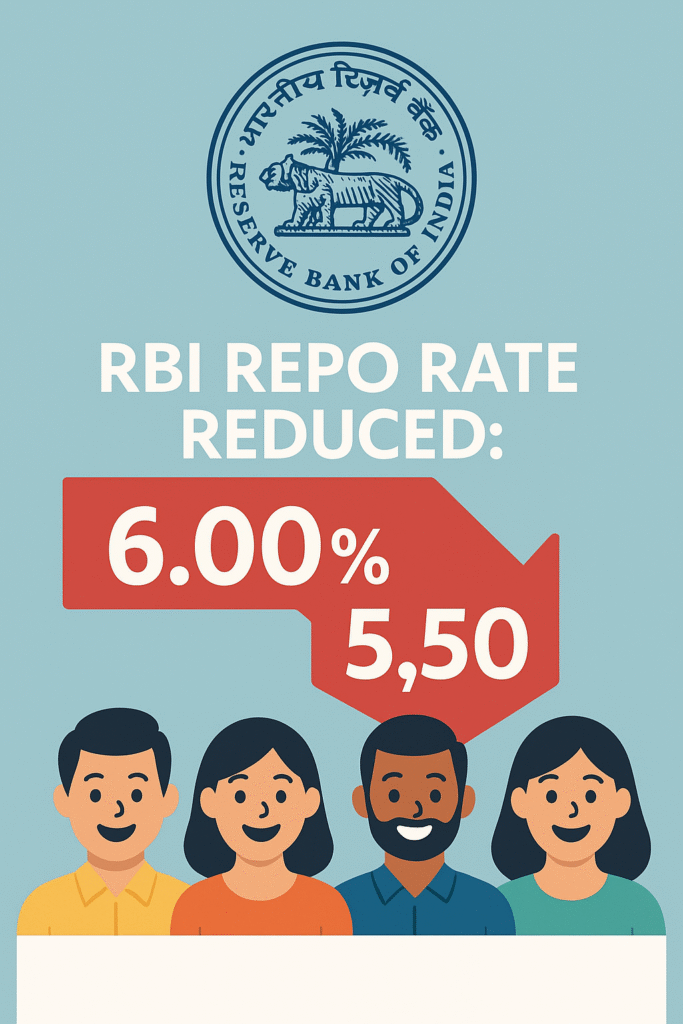

RBI Repo Rate Cut Today: MPC Meeting Slashes Repo to 5.50%, CRR Cut Announced | Impact on Home Loan Interest Rates

RBI Repo Rate Cut Today: MPC Meeting Slashes Repo to 5.50%, CRR Cut Announced | Impact on Home Loan Interest Rates

The Reserve Bank of India (RBI), the central bank of India, has announced good news for bank account holders.

The Reserve Bank of India has reduced the REBCO interest rate from 6% to 5.50%, the third time in 2025, by 0.5%.

The reserve requirement ratio has been reduced from 4% to 3%, which may lead to a decrease in cash reserves and liquidity in banks. It is noteworthy that this is the first time since the Corona pandemic that the interest rate has been reduced by this amount.

With this interest rate cut, the GDP is expected to grow by 6.5% in the financial year 2025-2026.

The Reserve Bank of India has also projected that inflation will come down to 3.16% in April.

Who will benefit from this interest rate cut?

- In such a type of interest reduction, only personal and home interest will reduce vehicle interest rates. This may reduce the bank’s EMI period.

- It is worth noting that the EMI of those who received interest on floating interest has exceeded 100 years during the Corona period. Due to this, some banks will encourage banks to take loans at an interest rate of 8%.

This may increase the purchasing power of the people. - Due to this interest reduction, Indian families can save 35,000 per year in EMI payments.

- However, the interest rate of those who have money in the bank may decrease.

Stock market situation

- After the news of REBCO interest reduction was released, the Sensex rose by 747 points to 81,442 points.

- NIFTY also rose by 50 points to cross 25,000 points.

- The Indian rupee has strengthened to 85.66 against the dollar.

- Therefore, the price of gold and imported goods from abroad may decrease.

RBI Governor Shakti Kantadas said

“The interest rate has been cut to promote growth while inflation is under control, so that the purchasing power of the people will increase and the Indian economy will move towards growth.”

Expectation

Economists have estimated that the interest rate of the Recbo bank is likely to be reduced to 5.25% by the end of 2025.

The next monetary policy statement of the RBI bank will be published in August.

Post your comments on whether this has been reduced for future political purposes or in the interest of the people.

Here is a single SEO title that smartly combines all your keywords while keeping it readable and relevant:

✅ Combined SEO Title:

RBI Repo Rate Cut Today: MPC Meeting Slashes Repo to 5.50%, CRR Cut Announced | Impact on Home Loan Interest Rates, IDFC First Bank, SBI, Nifty Bank, RBL, Bank Nifty, Stocks | RBI Monetary Policy News Live – CNBC Awaaz, Moneycontrol, Nasdaq

Here are the meta description and SEO tags for your news blog on the RBI repo rate cut:

📝 Meta Description:

The RBI has cut the repo rate to 5.50% and reduced the CRR to 3.00% in today’s MPC meeting. Get the latest updates on RBI monetary policy, home loan interest rates, SBI and IDFC First Bank share prices, Nifty Bank, Bank Nifty, and market reactions. Track live news via CNBC Awaaz, Moneycontrol, and more.

🔖 SEO Tags / Keywords:

RBI repo rate cut, repo rate today, RBI rate cut news, RBI MPC meeting, CRR cut, RBI monetary policy, repo rate news, home loan interest rate, SBI home loan interest rate, IDFC First Bank share price, RBL, Bank Nifty, Nifty Bank, RBI policy date, RBI meeting today, repo rate RBI, current repo rate, RBI repo rate news, RBI policy today, monetary policy, MPC meeting, RBI policy live, CNBC Awaaz, Moneycontrol, Nasdaq today, RBI news today, RBI cut repo rate, RBI repo rate today, RBI policy news, RBI news, stocks

Let me know if you’d like this formatted for WordPress, Blogger, or AMP-optimized blog structure.

One thought on “RBI Repo Rate Cut Today: MPC Meeting Slashes Repo to 5.50%, CRR Cut Announced | Impact on Home Loan Interest Rates”